Thursday, 29 August, 2019 06:51:49 PM

Higher Education in Malaysia

→ Professions in Accounting

Academy Level in Accounting

1- Bachelor of Accounting (Honors) - 4 years

2- Diploma in Business Studies (Accounting) - 2 years

An Accounting programme provides a spectrum of knowledge and skills required for

a career in the accountancy and finance profession.

The curriculum covers key areas such as financial accounting & reporting,

management accounting & control, accounting information systems, audit &

assurance, public sector accounting, taxation, corporate governance and

professional values & ethics.

Career Prospects for accounting graduates

• Accounting

• Corporate Reporting

• Corporate Finance

• Management Accounting

• Financial Management • Assurance Services

• Treasury

• Taxation

• Business Analysis

• Business Consultancy

• Finance

• Risk Management • Advisory

• Financial Analysis

The UK and Malaysia have been producing world-class accounting graduates for

the past 50 years. Accountancy qualifications open up many opportunities in

different fields of human activity. There is probably no better entry to top

jobs in business and industry, management and financial consulting than working

to become a highly qualified and experienced accountant.

From auditors to business advisers, the role of accountants has changed

significantly over the years. With this expanded role, their education and

training have also changed. Apart from learning the traditional bookkeeping

techniques, they are now required to possess a wider scope of knowledge:

economics, management, law, finance, marketing etc.

To achieve this, a degree is not essential but degrees in certain subjects will

earn exemptions from one or more parts of the professional accounting

examinations. The main routes to become an accountant are as listed below:

• Academic route:

- Degree in a subject with direct relevaance eg accounting, business studies, law

mathematics, economics or MBA

- Academic qualifications equivalent to STPM or other pre-university courses for

entry to professional accounting courses such as ACCA, CIMA and AIA

• Professional route:

- Period of up to four years, practical training while taking professional

qualifications at the same time, such as with the Institute of Chartered

Accountants in England and Wales.

The variety and scope of the accounting profession can be broadly divided into

four areas. These are chartered accountants, certified accountants, public

finance accountants and management accountants. The differences between them are

mainly in the type of finance work that is can be done such as financial

strategy, risk management, financial services, auditing, taxation and banking as

well as the type of organization that requires the service such as the

government, banks, public listed companies and a whole host of other

institutions.

In a nutshell, students will be trained to perform in an evolving industry and

to exacting standards. There is a need for individuals with multidisciplinary

skills who are able and accountable. The UK has the most stringent financial

regulations in the world, in a global climate where now even seemingly innocuous

transactions come under the microscope. In a rapidly evolving global

marketplace, UK educators are matching the pace of change to offer relevant

courses to the brightest students. For UK accountancy graduates the

possibilities are endless.

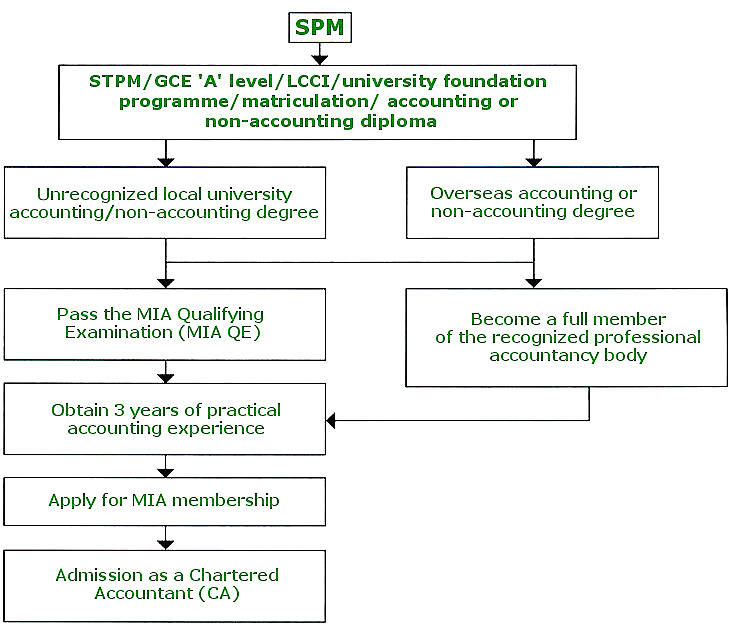

ROUTE TO BECOMING A CHARTERED ACCOUNTANT IN MALAYSIA (1)

(Part I of the First Schedule of the Accountants Acts, 1967)

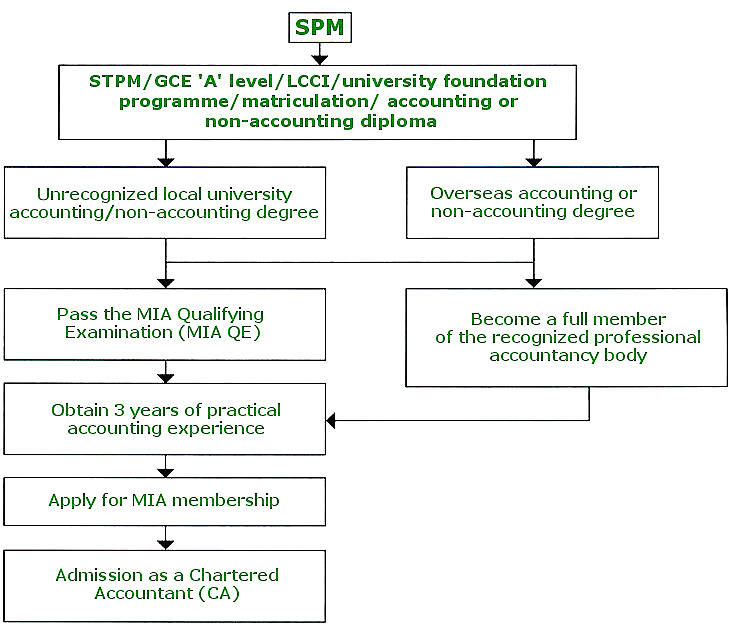

ROUTE TO BECOMING A CHARTERED ACCOUNTANT IN MALAYSIA (2)

(Part II of the First Schedule of the Accountants Acts, 1967)

Malaysian Institute of Accountants (MIA)

Recognized Local Accountancy Degrees (Part I of the First Schedule of the

Accountants Act, 1967)*

| Bachelor of

Accounting, Universiti Malaya

|

| Diploma in

Accounting, Universiti Malaya (up to

examination session 1981/82)

|

| Bachelor of

Accounting (Hons), Universiti Kebangsaan

Malaysia

|

| Bachelor of

Accounting (Hons), Universiti Teknologi

Mara

|

| Advanced Diploma in

Accountancy, Institut Teknologi

Mara (up to Oct 1996)

|

| Bachelor of

Accounting (Hons), Universiti Utara

Malaysia

|

| Bachelor of

Accounting (Hons), (Information Systems),

Universiti Utara Malaysia

|

| Bachelor of

Accounting (Hons), Universiti Putra

Malaysia

|

| Bachelor of

Accounting (Hons), International Islamic

University

|

| Bachelor of

Accounting (Hons), Universiti Sains

Malaysia

|

| Bachelor of

Accounting (Hons), Malaysia Multimedia

University (academic programme for which

commenced from the academic year 2002/03

onwards)

|

| Bachelor of

Accounting (Hons), Universiti Tenaga

Nasional (academic programme for which

commenced from the academic year 2002/03

onwards)

|

| Bachelor of

Accounting (Hons), Kolej Universiti Sains &

Teknologi Malaysia

|

| Bachelor of

Accounting (Hons), Universiti .-Malaysia

Sabah |

Recognized Professional Accountancy Bodies

(Part II of the First Schedule of the Accountants Act, 1967)

| Malaysian Institute

of Certified Public Accountants

|

| Institute of

Chartered Accountants of Scotland

|

| Institute of

Chartered Accountants in England and

Wales

|

| Institute of

Chartered Accountants in Ireland

|

| Association of

Chartered Certified Accountants (United

Kingdom)

|

| Institute of

Chartered Accountants in Australia

|

| CPA Australia

|

| New Zealand

Institute of Chartered Accountants

|

| Canadian Institute

of Chartered Accountants

|

| Institute of

Chartered Accountants of India

|

| Chartered Institute

of Management Accountants

(United Kingdom) |

Committed to Progress & Quality

Malaysian Institute of Accountants (MIA) is the profession's regulatory body of

policing and enforcement.

It has been shown that there is a direct correlation between a country's level

of development vis-à-vis the size. level and standards of the accountancy

profession. Accountants are crucial when it comes to recording, collating and

summarizing raw financial data into reports. They interpret, analyze and

recommend corrective actions. They are the watchdogs of business and governance.

Since business is the lifeblood of Malaysia, it stands to reason that promoting

quality accountancy practices will raise the standard of governance and business

in Malaysia. MIA is dedicated to raising the bar of accounting quality, We are

committed to our mission of developing and sustaining professional quality and

expertise that can meet the most demanding global standards.

Development is also crucial to guarantee the accountant a place in the future.

Currently, Malaysia is in the process of transformation, shifting from an

industrial economy to a knowledge-based economy. As a business changes,

requirements become more fluid, the accountant is no longer a mere number-

cruncher. Instead, an accountant must be technically competent and informed on a

wide variety of subjects, in order to provide the best and highest value-added

services for his or her clients.

MIA is dedicated towards moulding and shaping this new breed of accountants by

providing opportunities for lifelong learning. To sustain professional

development and growth, MIA has chosen to deliver education and training via the

key channels of conventions, conferences, seminars and workshop, all of which

are held on regular basis.

Governing the Profession

The Malaysian Institute of Accountants (MIA) was established in 1967 under the

Accountants Act 1967 (Act') as the regulatory body of the profession in

Malaysia. Thus, it also represents the voice of all accountants in the country.

In Malaysia, the word 'accountant' is protected under the provisions of the Act,

which states that no one can hold himself or herself out or practice as an

accountant unless he or she is registered as a member of MIA.

The Institute is governed by a Council whose powers are set out under Sections 9

and 10 of the Act, The Council comprises 30 members including the

Accountant-General. Others in the Council include the President of the Malaysian

Institute of Certified Public Accountants (MICPA, previously MACPA); 10 members

elected at the annual general meeting; and up to 18 members appointed by the

Government including members from recognized institutions of higher learning and

recognized professional bodies.

Malaysian Institute of Accountants (MIA) Duties

The Institute's statutory functions inter alias are:

To determine the qualifications of persons for admission as members

To provide for the training and education by the Institute or any other body of

persons practicing or intending to practice the profession of accountancy

To regulate the practice of the accountancy profession in Malaysia

To promote, in any manner it thinks fit. the interests of the accountancy

profession in Malaysia

As the national accountancy body, MIA sets high ethical standards which must be

adhered to by all accountants in Malaysia. All accountants are bound by MIA's

strict code contained in the MIA's By-Laws (On Professional Conduct and Ethics),

Any breach of these By-Laws by members may render them liable to face

disciplinary proceedings,

The Institute also monitors local and international accounting developments and

consults regularly with government and statutory bodies. Members of MIA receive

technical support and information on the latest developments in the profession

through the Institute's Continuing Professional Education (CPE) programme and

the Institute's magazine. Accountants Today, as well as through circulars,

updates and other pronouncements.

In the international arena, MIA is a member of the International Federation of

Accountants (IFAC). It supports the work of this body and adopts as far as

possible the IFAC pronouncements in Malaysia. MIA is represented in the

International Auditing and Assurance Standards Board (IAASB). In the regional

scene, MIA plays a proactive role as a member of the Confederation of Asian and

Pacific Accountants (CAPA) and the Asean Federation of Accountants (AFA).

MIA QE: Alternative Route

Eligibility

Section 15A (2) of the Act provides that a person shall only be eligible to sit

for the MIA Qualifying Examination if he/ she possesses a qualification relating

to accounting, business or finance recognized by the Public Services Department

or other qualifications approved by the MIA Council. This includes;

overseas graduates

students who have graduated from twinning programmes

students who have graduated from 3+0 programmes

However, pursuant to Rule 3 (3) of the Malaysian Institute of Accountants QE

Rules, 2002, the accounting content in the above qualifications must not be less

than 60 per cent of the total qualification that will be assessed by the MIA

Examination Committee.

Application of Candidacy

Interested applicants are requested to submit the application form for candidacy

together with the processing and candidacy fees amounting to RM 300.OO/- to MIA

to be processed by the MIA Examination Committee. The application form for

candidacy can be obtained at the MIA office or downloaded from the MIA website

at www.mia.org.my. The Examination Committee will issue the successful candidate

with a Certificate of Candidacy that will be valid for a period of two years.

For those whose applications are rejected by the Examination Committee or

withdrawn by the applicants, MIA will refund the candidacy fee of RM 200.00.

Application for Examination.

An application to sit for the MIA QE shall be submitted to the Examination

Committee in the prescribed form together with a copy of the Certificate of

Candidacy. This application form can be obtained at the MIA office or downloaded

from the Institute's website. The examination consists of four (4) papers and

candidates have the option of registering for all four (4) papers at one sitting

or stagger the papers over a maximum period of four years. The examination fee

is RM200 per paper. The examination will be held twice every calendar year in

March and September.

Examination Syllabus.

The MIA QE consists of four (4) papers as listed below:

Business and Company Law (BCL)

Auditing and Assurance Services (ADD)

Taxation (TAX)

Advanced Financial Accounting and Reporting (AFAR)

The syllabus for each examination paper is designed to assess the candidate's

knowledge and skills in the respective area of study.

OBJECTIVE - BCL To provide a sound knowledge of the core elements of Malaysian

Business Law together with a through understanding of the Malaysian Company Law

and its regulations with their applications in the management and administration

of companies.

OBJECTIVE - AUD To equip candidates with knowledge and understanding of the

audit process when performing the audit of financial statements including

consideration of other issues relating to provisions of audit-related and

assurance services.

OBJECTIVE - TAX To equip candidates with the knowledge and understanding of the

basic concepts, principles and current tax practices in Malaysia as well as the

ability to solve practical problems and to be familiar with aspects of other

relevant legislation.

OBJECTIVE - AFAR To equip candidates with knowledge and skill in applying

financial reporting standards in preparing financial statements for public

companies including group of companies.

Examination Administration

Universiti Teknologi Mara (UiTM) has been appointed as the examination body to

conduct the MIA QE for a period of three years. UiTM will set the examination,

mark and assess the answer scripts and forward the examination results to the

MIA Examination Committee. The university was selected based on its impressive

track record, staff strength and excellent infrastructure.

Examination Centre(s)

In addition to its campus in Shah Alam, UiTM may conduct the examination at

selected centres in Johor Bharu, Melaka, Ipoh/ Pulau Pinang, Kota Bharu, Kuantan,

Kuching and Kota Kinabalu, if there are a minimum number of candidates in these

states.

Certificate of Successful Completion and Membership into MIA

Upon completion of all four papers, the successful candidate will obtain a

Certificate of Successful Completion from MIA. To qualify for MIA membership, in

addition to obtaining the Certificate of Successful Completion, applicants would

need to gain three (3) years of practical accounting experience in the service

of a chartered accountant or in a government department, bank, insurance

company, local authority or other commercial, financial. industrial or

professional organization or other undertaking approved by the MIA Council.

MIA QE : Application Process

Submit application for Certificate of Candidacy to MIA with

a. Processing fee : RM 100,00 (non-refundable)

b. Candidacy fee : RM 200.00

Approval by MIA Examination Committee

Issuance of Certificate of Candidacy

Submit Application for Examination to MIA (1-4 papers) with relevant fees (RM200

per paper)

Issuance of Examination Docket

Sit for Examination

Notification of results/ issuance of Certificate of Successful Completion by MIA

How to Become an MIA Member

All persons practicing as accountants or auditors in Malaysia must be registered

with the Institute. There are three categories of membership:

Chartered Accountants

Licensed Accountants

Associate Members

One can become an MIA member by pursuing one of the following routes.

A. Applicants In The Chartered Accountant Category Must Possess One Of The

Following:

Passed any of the final examinations specified in *Part 1 of the First Schedule

of the Accountants Act 1967 and has not less than three (3) years' practical

accounting experience in the service of a chartered accountant or in a

Government department, bank, insurance company, local authority or other

commercial, financial, industrial or professional organization or other

undertaking approved by the MIA Council

Member of any of the recognized bodies specified in **Part II of the First

Schedule of the Accountants Act, 1967

Eligible to sit for and passed the MIA Qualifying Examination and has not less

than three (3) years' practical accounting experience in the service of a

chartered accountant or in a Government department, bank, insurance company,

local authority or other commercial, financial, industrial or professional

organization or other undertaking approved by the MIA Council.

B. Applicants In The Licensed Accountant Category Must Satisfy The Following:

Member of the Malaysian Society of Accountants (MSA) and has passed any of the

final examinations of that body last held in December 1992 and has gained at

least three (3) years' practical accounting experience in the service of a

chartered accountant or in a Government department, bank, insurance company,

local authority or other commercial, financial, industrial or professional

organization or other undertaking approved by the MIA Council.

C. Applicants In The Associate Member Category Must Satisfy The Following:

Possess a first degree and/or is a member of any of the recognized bodies

specified in **Part II of the First Schedule of the Accountants Act 1967, and a

Master's degree or higher, in which he or she must have a major in accounting

for either his or her first degree or Master's degree or higher; and he or she

has not less than three (3) years' experience in teaching accounting or

accounting related subjects at an institution of higher learning or equivalent.